How to Get A

Secured Credit Card With Poor Credit History

Secured credit cards are designed for

those who have poor or nonexistent credit history who are looking to build

their credit and eventually upgrade to better

credit cards.

Because these cards are typically given

out to those with a low credit score who may not be approved for more

mainstream credit cards, a form of collateral is needed for acceptance.

Most of the time, this collateral is

simply a security deposit to ensure the card provider. The amount of the

deposit typically determines the credit line that is approved and can range

from $200 to $500. The deposit is required in case you ever forget to pay off a

monthly bill, which will then be covered by a portion (or all) of your deposit.

The following infographic from CreditOne bank

displays the differences between secured and standard credit cards:

In this short guide, we’ll be discussing

the steps needed to acquire a secured credit card, our top recommendations, and

potential alternatives.

How to get A

Secured Credit Card

While secured cards are typically easily

accessible for those with a low or nonexistent credit score, it doesn’t mean

that everyone is approved for one.

Who

Gets Approved?

One of the first things that the issuer

will do when you’ve inquired for a secured credit card is analyze your credit

report and check for any signs that may show you are an unacceptable credit

risk, and therefore not eligible for a secured card. For example, possible

signs could include too many open accounts, a recent file for bankruptcy, or if

you’re far behind on other accounts.

Additionally, proof of income is

typically required in order to prove that you’ll be able to pay off the monthly

bills. Your deposit is there for insurance in case you occasionally slip up,

however, this is only used by issuers in a very resort scenario. Your income is

the expected channel of paying off the bills, therefore in most cases, it’s

required to be proven.

It’s also important to keep in mind that

all secured credit card issuers are different, so it’s essential to do adequate

research on each one and determine you have the right qualifications and income

to be accepted.

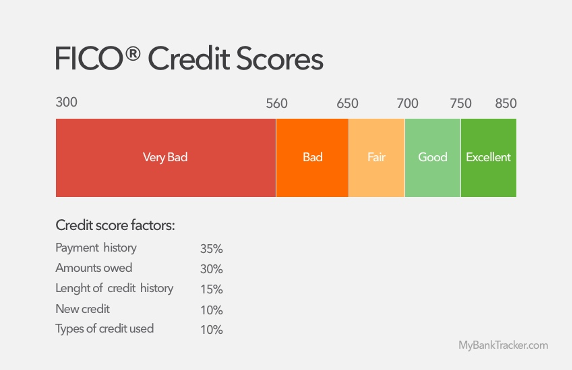

The following infographic from MyBankTracker show’s the difference between credit scores as well as what

impacts it. This is a great reference when determining your own credit health

and strategizing a plan to build it up.

The

Process

The actual process for applying and

acquiring a secured credit card is pretty similar to the process for standard

cards. However, each step is important to follow correctly as you’re trying to

build your credit score back up or from the ground up, which has risks of its

own.

1.

Application

The application process itself is

typically very straight forward. You apply for the card directly from the

issuer, and then it’s their time to evaluate the risk of accepting your request

based on the factors mentioned above.

If you check off the qualification boxes,

then congratulations! You’re approved.

2.

Fund Deposit

After approval, the next step is

submitting your initial deposit. Most issuers won’t open your account until

this deposit is secured. Bank account information is required in some cases to

allow for instant transfer of funds for the deposit, thus meaning instant

access to your secured credit card account.

However, it’s also normal for issuers to

allow for some time (typically up to a week) for the deposit to be made. If the

deposit is failed to be made, your approval status for the secured credit card

will most likely be stripped and declined.

3.

Receive & Activate Card

After approval, and after the deposit

funds have been submitted, you’re just about done! Now, the issuer will send

you your card, and you can begin using it as normal.

When trying to build credit, in general,

it's best to use less than 30% of your available credit at any given time. It’s

also especially important to not max

out your card shortly after receiving it. This is asking for a worse credit

score and the possibility of getting your secured card rejected.

4.

Consistently Pay Bills

Due to the nature of secured cards and

that they’re typically used by those with a low credit score, the interest

rates are usually very high. Because of this, it’s best to pay your bill in full each month to avoid racking up

ridiculous fees in interest rates.

5.

Upgrade to Better Cards

The whole goal of using a secured credit

card is to build up your score and increase your credit reputation with banks

and lenders. If you’ve been consistently using your secured credit card, and

paying off your monthly bills on time, it won’t take too long to start seeing

the increase in your score.

Once you’re ready, it can be time to

start looking for credit card upgrades to an unsecured credit card, both in the

way of extended credit, lower interest rates as well as an increased number of

perks and benefits. These upgrades can sometimes be done directly through your

secured card issuer. In other cases, you’ll have to contact your bank and

convert your secured account to an unsecured account in order to apply for an

upgraded unsecured credit card.

Top

5 Picks

At OurComparisons,

we extensively analyze secured credit card providers to provide you with

updated, accurate recommendations to base your secured card decisions off of.

These are our top 5 recommendations for

2020, you can view

our full list here.

1.

Green Dot Visa® Secured Credit Card

●

Credit lines available from $200

to $5,000. Low purchase and cash advance APR of

19.99% -- — with no penalty rate.

●

No minimum credit score

requirements! All credit types are invited to apply, no fees.

●

It helps strengthen your credit

with responsible card use. Reports to three national bureaus.

●

Fast, easy application process.

Choose your credit line and open your Personal Savings Deposit Account to

secure your line.

●

Initial security deposit can be as

low as $200

2.

Green Dot primor® Visa® Classic Secured Credit Card

●

Credit lines available from $200

to $5,000! Low fixed 13.99% interest rate on purchases - with no penalty rate!

●

No minimum credit score

requirements

●

It helps strengthen your credit

with responsible card use. Reports to three national bureaus

●

Fast, easy application process.

Choose your credit line and open your Personal Savings Deposit Account to

secure your line

3.

Applied Bank Gold Visa

●

Better than Prepaid…Go with a

Secured Card! Load One Time — Keep On Using

●

Absolutely No Credit Check or

Minimum Credit Score Required

●

Automatic Reporting to All Three

National Credit Bureaus

●

9.99% Low Fixed APR — Your Rate

Won’t Go Up Even if You Are Late

●

Activate Today with a $200 Minimum

Deposit -- — Maximum $1,000. Increase Your Credit Limit up to $5,000 by Adding

Additional Deposits Anytime

4.

First Progress Platinum Elite Mastercard

●

Receive Your Card More Quickly with New Expedited Processing Option

No Credit History or Minimum Credit Score Required for Approval

●

Quick and Complete Online Application; No credit inquiry required!

●

Includes Free Real-Time Access to Your Credit Score and Ongoing Credit Monitoring powered by Experian

●

Full-Feature Platinum Mastercard® Secured Credit Card; Try our new Mobile App for Android users!

5.

Group One Platinum

●

Get approved in seconds with our

simple online credit application

●

Guaranteed $500 credit line with

Group One Platinum

●

Monthly Reporting to all 3 Major

Credit Bureaus to Establish Credit History

●

0% interest fee

●

Bad credit, no credit? No problem!

●

No employment or credit check

●

Member initiation fee $29.95 due

on approval

Secured cards are a great option for

those with poor or nonexistent credit card histories to begin building up their

score, as well as gaining access to credit that would otherwise most likely not

be approved.